Payroll

The Payroll Module controls all the procedures involved in the processing of a Payrun, including the processing of employee transactions from Self Service. It allows for automatic generation of pay for those employees whose pay does not change and for several different types of time card entries. You may enter time card details on-line, concurrently and through a time interpretation system. Also available is the General Ledger Interface, an optional module within Preceda, to prepare data for exporting to your General Ledger software.

The Payroll Module also includes descriptions of the Standard Payroll Processing Run, Time Interpretation, Batch Processing, Time Entry, Payrun Processing and Period End Procedures. Extra Pays for Payments such as missed overtime, casual wages, immediate terminations etc are also possible to generate.

Within the Payroll folder, the following folders (functions) are located:

- Data Entry is where all time card entry is completed, including worked hours, leave and allowances and deductions.

- Enquiry is where you can review payroll calculations for individual employees.

- T & A Interface is where your time and attendance interface can be accessed.

- Express Payments Entry is where you can enter details for any payrun outside a regular payrun.

- Express Payments Processing is where you can create and download the EFT files for any Express Payments.

- Self Service Transactions is from where Self Service entries can be imported.

- Pre Payroll are all of the functions to be completed prior to processing a payroll.

- Processing are the actual calculations of the payroll.

- Reports folder is where the payroll associated reports are accessed from.

- Labour Costing is where you are able to manage the import of labour costing tables, if required.

- Period to Date is where any Period to Date reports are available for processing.

- Period End is the folder where Period End reports are available for processing.

- Period End Consolidation is the folder where concurrent payrolls are consolidated for period end processing.

- Period End Audit Reports is where the Period to Date data is reset.

- General Ledger is where you are able to process a file to import into your GL.

- Superannuation Processing is where you are able to maintain SGC details.

- Year End is the folder containing the year-end processes - trained separately each year in accordance with the latest legislative changes. This enables users to successfully complete all Year End functions, including the production of Certificate of Earnings.

- PAYG Tax Reporting is where PAYG reports are available for processing.

- Reference is where the codes and rules are established and maintained.

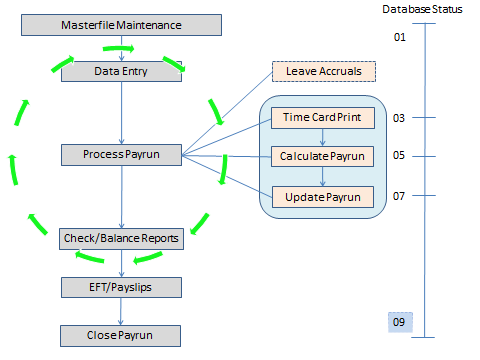

Payroll Cycle Sample

Whilst this flow chart outlines the logical stages of a payroll, many of the stages can be re-ordered to suit your own business processes - your Preceda consultant will assist you in creating procedures that are relevant to your business.

This stage of the Payrun is used to ensure that all maintenance is up to date with both the Reference Tables and Employee Records. Generally Reference Tables and Employee Records may be maintained at any time; however you should always bear in mind the impact that any additions, deletions or changes will have on a Payrun. It is wise to ensure that maintenance is completed before commencing Time Entry.

This stage of the payroll cycle is necessary only if you use Leave Accruals. It can be processed at any stage; however, it is recommended to process it at the same stage of your payroll processing in order for the accruals to be calculated at the same level each pay.

If you do not want to calculate Leave Accruals at this stage, you may omit this step.

The Payrun Header contains essential information about the Payrun. Before proceeding to enter details of time and payroll variances such as holiday pay and Personal Leave (formerly Sick Leave), Preceda needs to be advised of the details of the payroll you are processing.

This stage can be completed at any time after the Pay Header has been established, and will follow one of these methods:

- On-line time entry. This is the standard means of entering time details to the server. This means you manually enter time card details through Entry via Single Screen. This method ensures information is always up to date.

- Concurrent time entry. This is a means by which you may assign yourself to a portion of the payroll and process that portion through all the stages of a Payrun, whilst data entry for time on other sections of the payroll still proceed on other sites/terminals.

- External Time processing. This facility allows the merging of time details from your Time Interpretation system (such as Preceda Time) into Preceda, where they become part of the normal Payrun. This feature is optional and is not discussed in this User Guide.

- Import Self Service Transactions. If you are using ESS, you will need to approve and import the transactions at this stage.

Users may vary when they choose to run this Before Payrun Backup. The important thing is that you have a backup of your files prior to running the Calculate Pay stage, which is why this function is within the Pre-Payroll folder.

You may elect to run it after the entry of Employee Records and Reference Table maintenance and then again before you Calculate Leave Accruals or after you have completed Time entry. This would ensure that the data is saved at each stage in case of error.

When you run the backup using the Save File option, each successive PAYBEF would over-write the previous back up. If using Pay Run Environments, only the previous (same) environment will be overridden.

This will provide an editing report for checking the details of pays created during the time entry processes, and is located within the Processing folder.

This is the stage where Preceda calculates the pay according to the time details entered.

When the pay has been calculated and the reports have been checked thoroughly, the Employee Records (which store all Personal details) must be updated with the resulting calculations. You can re-set the Payrun at any stage before this step. History is updated during this stage for Earnings and Leave. General Ledger Interface transactions are also set aside for posting at a later time.

You will need to establish your own company requirements for reports. Preceda provides a large number of reports to assist you. Also, at this stage you should create the EFT file for banking of wages.

This is the final stage in the Payrun. It must be completed before another Payrun may be commenced. It includes a backup of the entire system.