FB Import

This window imports Fringe Benefit details from a PC file (or an external source such as an accounting software) and converts them to the System format.

Prerequisites

- Year End Processing Status is N (Not Processed) or I (Completely Ignored).

Rules and Guidelines

- The Import will only be allowed for employees whose Year End Processing Status is N (Not Processed) or I (Completely Ignored). When the Year End Processing Status is P (Partially Processed) or F (Fully Processed), an error message "Employee Finalised" will appear on the Fringe Benefit Import Audit Report (PRE330A).

- When submitted in Batch, the import file will be validated to ensure that no incorrect information is passed to the employee record.

- Invalid records are reported as errors on the PPRE330A report and the process will not continue.

- Only when there are no errors reported will the employee's records be updated.

- If no errors occur, the process of updating the employee records with FBT details is performed.

- Any update will replace existing FBT records on the employee file.

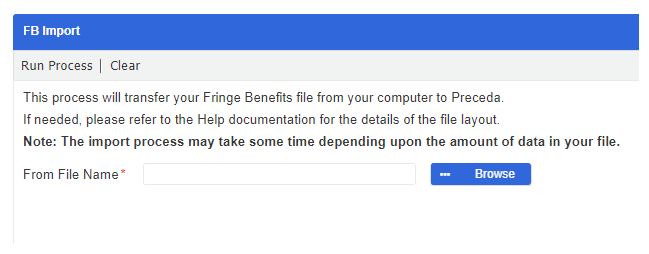

- Enter the path name or Browse for the Fringe Benefit data to be imported into Preceda.

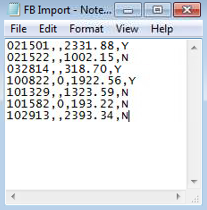

- The file to be transferred from the PC to the Server must be a comma-separated file which contains the ID number (6 digits), the Version (1 digit or blank), the Reportable Fringe Benefit Amount (10 digits), and the FBT Exempt (1 alpha or blank).

- If the finance department supplies this information as an Excel file, it has to be converted into a .txt format before being imported into Preceda.

Example

ExampleThe file needs to contain the following data:

Field Description ID Number This refers to a valid employee number that can be contained within quotes.

- A maximum length of 6 characters is allowed.

Employee Version This refers to a valid employee version number for the selected employee.

- A maximum length of 1 character is allowed. This may be contained within quotes.

- For the current employee, this will always be blank (i.e. " ")

- The exception to this is if the employees has been transferred or reinstated and a previous record is to be updated. In this instance, the appropriate version number is needed.

Reportable Fringe Benefit Amount This value is in dollars and cents with 2 decimal places.

- Zero cents may be omitted.

- A maximum length of 10 characters is allowed.

- The value may be contained within quotes and should not have any currency symbols such as $.

- Commas are not accepted.

FBT Exempt A maximum length of 1 character is allowed (Y or N).

When should I tick (Y)?

When should I tick (Y)?The FBT Exempt should only be ticked (set as Y) if the Payer is eligible for exemption from fringe benefits tax as described under section 57-A of the Fringe Benefits Tax Assessment Act 1986.

FBT exemption refers to a payer of the payee you are either:

- A registered public benevolent institution that is endorsed by the Commissioner of Taxation as eligible for exemption from Fringe benefits tax;

- A public hospital;

- A hospital carried on by a society or association that is a rebatable employer;

- A health promotion charity that is endorsed by the Commissioner of Taxation as eligible for exemption from Fringe benefits tax; or

- You provide a public ambulance service.

When should I untick/ leave blank (N)?

When should I untick/ leave blank (N)?All other payers, irrespective of your eligibility for exemption from Fringe benefits tax, must be unticked (N) in the FBT Exempt.

If the Reportable Fringe Benefit Amount field is zero for all employees, then the FBT Exempt must be unticked (Blank).

Note:

Note:- If the Reportable Fringe Benefit Amount field is greater than zero, then the FBT Exempt must be ticked (Y). If the Reportable Fringe Benefit Amount field is zero, then the FBT Exempt must be blank.

If an employer provides multiple fringe benefit amounts to the same payee in the same fringe benefit period, and at least one amount complies with section 57A of the Fringe Benefits Tax Assessment Act 1986, and at least one other amount does not comply, then two separate Payment Summaries are required.

- When submitted in Batch, the import file will be validated to ensure that no incorrect information is passed to the employee record. Invalid records are reported as errors on the PPRE330A report, and the import will not continue.

- Only when there are no errors reported will the file be uploaded. If no error occurs, the process for bulk updating the Fringe Benefits Amounts is performed.

- Any update will replace existing FBT details on the employee file.

Field Information

Select the Browse button and locate the path and name of the file to import.

Note: This process may take a while.

Select Run Process to convert/import the file.