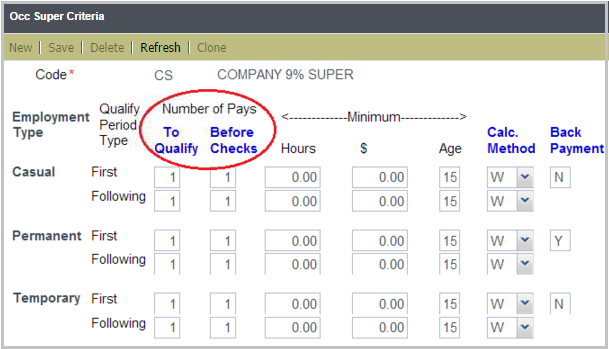

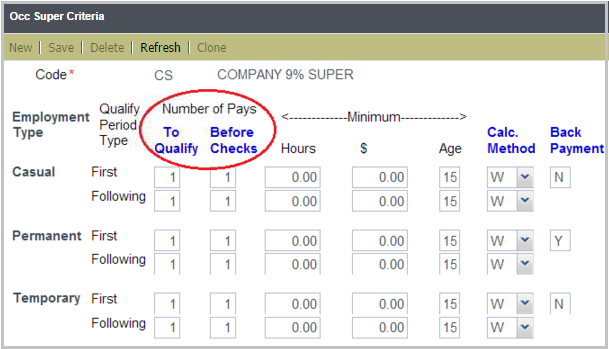

This determines if employees qualify for Occupational Superannuation; where contributions are accumulated during the first qualifying period with the option of allocating those contributions (back pay) to the employee.

Using the above example:

Please complete the form below to give us feedback. If you need any assistance with this functionality, please contact Preceda Support.

|

|

Version 15.3.01 Preceda Knowledge Base

For feedback and comments, please contact your Systems Administrator or Account Manager. |

| |