When the close G/L Posting PTD File process is run:

Where the amount is not exact after dividing, figures are rounded up. Adjustments are made in the final week of the month.

Without Equalisation Percentage

An employee is paid $4000.00 per month.

The month that the employee is paid is setup in the G/L Equalisation Percentage window as having 4 weeks.

When the Close G/L Posting PTD File process is run:

With Equalisation Percentage

An employee is paid $4000.00 per month.

The month that the employee is paid is setup in the G/L Equalisation Percentage window as having 4 weeks and the Equalisation Percentage for the month is 10%.

When the Close G/L Posting PTD File process is run:

With Equalisation Percentage & Oncost

An employee is paid $4000.00 per month.

The month that the employee is paid is setup in the G/L Equalisation Percentages window as having 4 weeks and the Equalisation Percentage for the month is 10%.

The Oncost for the amount of 5%.

When the Close G/L Posting PTE File is process is run:

General Ledger Oncosts are applied to the calculated equalisation percentage amount ONLY if the oncost itself is a percentage.

Oncosts based on an hour/rate calculation are ignored when calculating oncosts on the equalisation amount.

When this equalisation process is activated, the windows used to setup the General Ledger Account numbers allow the entry of Equalisation Account numbers.

From the G/L Primary Post Payroll window, two fields G/L Equalisation Debit Acct No. and G/L Equalisation Credit Acct No. are provided to allow the entry of account number to be used in the posting process.

Tax Reduction records are always posted to GL9000.

If using the General Ledger Interface to JDE Release 7 and have the Program Control window STATS activated to generate statistical records, the statistical records will always be posted to GL9000.

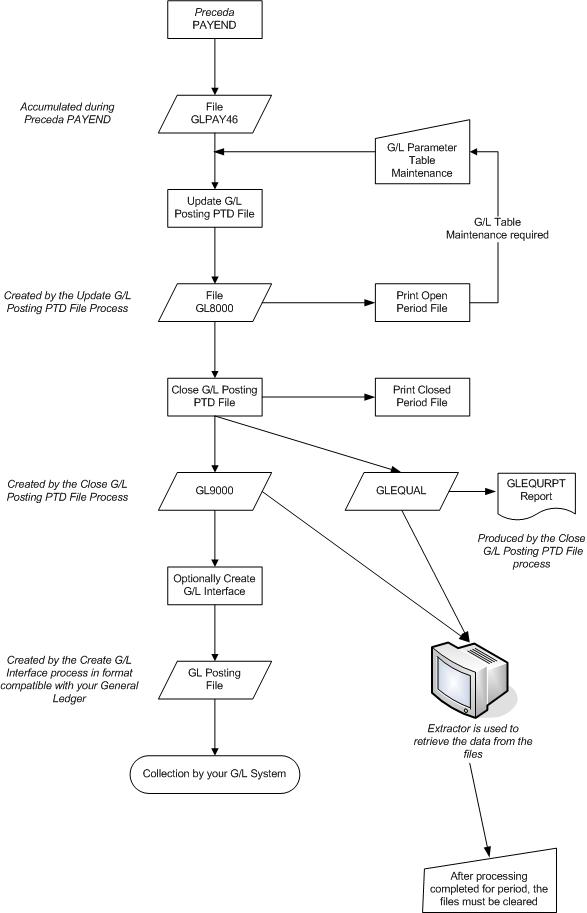

Processing

When the Close G/L Posting PTD File process is run:

Records in the GL9000 file can be posted to the General Ledger using the Create G/L Interface File process if needed.

The records held in the Closed Period File GL9000 and the GLEQUAL file are available in Extractor. Extractor is used to retrieve the information that can then be posted to the General Ledger as needed.

If Extractor is used, the GL9000 and GLEQUAL files should be manually cleared when processing is completed for the period.

Clearing the Files

There is no automatic process for clearing the GL9000 and GLEQUAL files. If the fields are not cleared at the end of the processing period, the accumulated figures will include data from previous periods. Therefore, when the extraction of records from the files for the processing period is complete, the files will have to be manually cleared before starting a new processing period.

The Clearing of Files is done by using the Clear G/L Posting PTD and Export File process.

Please complete the form below to give us feedback. If you need any assistance with this functionality, please contact Preceda Support.

|

|

Version 15.3.01 Preceda Knowledge Base

For feedback and comments, please contact your Systems Administrator or Account Manager. |

| |